7 Ways To Legally Avoid Paying Capital Gains Tax

Contents

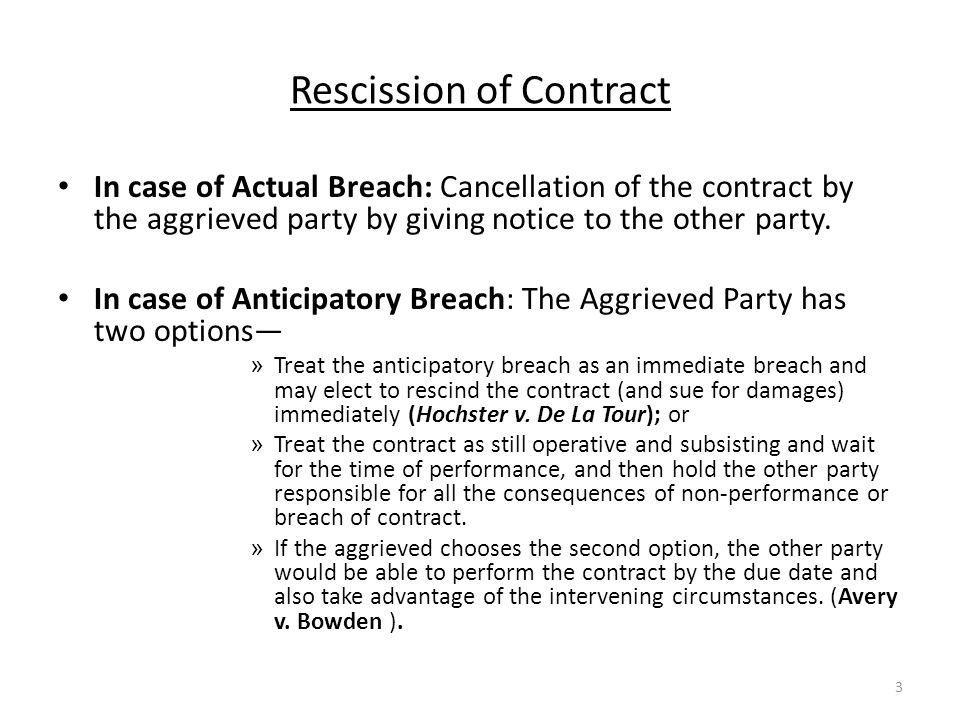

The net profit on a home sale is considered a capital gain and can be taxed. Were the capital gains tax abolished entirely, some of the lost tax would be regained through economic expansion and more efficient and liquid capital markets. Conversely, since capital gains taxes have been raised, the slowing of economic growth could reduce tax revenue by more than the additional tax collected. Because most savvy individuals can decide the timing and amount of capital gains they choose to realize each year, the capital gains tax is considered very elastic. The amount of capital gains realized depends heavily on the favorability of the capital gains tax rate. Losses on the sale of capital assets can be subtracted from capital gains in the same year, lowering your overall capital gains tax bill.

In this scenario, you sell the losing investment at the same time that you sell the profitable asset. This allows you to make the best of a bad situation by lowering the net capital gain that is taxed. But you can only exclude from taxation the capital gains above the original cost basis of the home. A capital gains tax is a tax on the gains you realized from the sale of an asset.

How are capital gains calculated on property?

These agents usually have hundreds of deals under their belts and know exactly what taxes apply in your particular situation and how you can avoid them. Before selling your home, always go through the real estate regulations of your state. Sometimes, there are special provisions that https://cryptolisting.org/ apply to your state and those provisions might help you get a tax break. The deceased’s estate does not have to pay CGT on any property or assets not sold before they passed away. The government considers these to be unrealised gains but does not require inheritors to pay a CGT.

In addition to selling precious metals through their storefronts, Birch Gold Group provides practical advice on tax planning for gold investments. If you sell your vacation home residence and buy another one, the IRS will not let you do a 1031 exchange . You can, however, exclude a large portion of the gain from your taxes as that you have lived in for two of the past five years in the property and used it as your primary residence. This means that you can sell the house and do whatever you want with the income without paying taxes on it. Generally, the IRS can take capital gains tax on anything you sell that makes a profit including stocks and bonds.

While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site.

FAQs about avoiding capital gains tax when selling a house

Investors can allocate their investment dollars based on the risk they are willing to take. Gold has historically been considered a safe investment for many reasons. It is also in limited supply, making it valuable for long-term investors. In addition, gold is often highly portable and used as a barter currency. As a result of gold’s use as money throughout history, some consider it to be the future of money. Property must be like-kind real estate held for business or investment purposes.

- Again, consult with us at Wealth Safe to see how this applies in your situation.

- So you’re left with a capital gain of $25,000 on this property.

- Navigating the ins and outs of capital gains taxes can be challenging.

- Additionally, to avoid paying even more in taxes, you should wait at least a year before selling any gold investments.

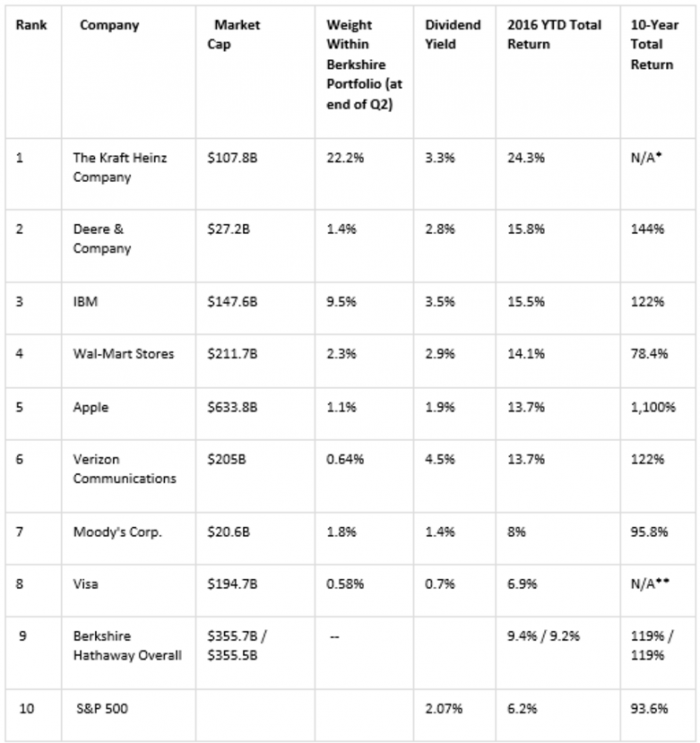

Additionally, to avoid paying even more in taxes, you should wait at least a year before selling any gold investments. Many American investors are caught off guard by the high tax rates that apply to selling real gold and other precious metals like silver, platinum and palladium. For this reason, gold and other precious metals are taxed at the same 28% long-term capital gains rate as « collectibles » by the U.S. Long-term capital gains rates of 15% or 20% apply to profits made on most other assets held for longer than a year.

Will The Capital Gains Tax Law Change?

The bottom line is that the IRS will modify the two-year residence requirement for you if your service pulled you away from home. You should also know the home’s date of sale to qualify for Section 121 exclusion. You must have owned your home for at least 24 months out of the last five years before the date of the sale. By signing up, you agree to ourTerms of Use andPrivacy Policy. You also elect to receive updates, newsletters, and offers from Personal Capital. This site is protected by reCAPTCHA, and Google’sPrivacy Policy andTerms of Service apply.

Keeping the home improvement receipts can save you from paying much capital gains tax given that they will serve as evidence of expenditure. The money you spend on improving your home will not be part of your capital gains tax when you sell your home. The simple reasoning is that the amount you spend on improving your home is an inherent expenditure of a home sale. Another time when the capital gains tax comes into play is when an individual inherits property. Often, the individual who inherits the property does not want to deal with the burden of keeping it.

What are capital gains taxes on real estate?

The resident must declare to the government that the foreign home will serve as a primary residence. Typically, homeowners must make this declaration within two years of purchasing the foreign property. The only way this would become problematic is if the UK resident decided to sell both their foreign property and UK property in the same year. You will either be subject to tax at the basic rate or the higher additional rate-payer.

So, before we begin, as long we’re clear, the world “avoid” DOES NOT mean skipping out on a tax bill and fleeing the country. However, there are expenses to account for, including the capital gains tax. A short-term gains tax will likely result in a higher tax rate, though. So, it may be worthwhile to hold on to a property long enough to qualify for the long-term gains tax. Different types of properties may also result in changes to your potential taxes, so make sure you’ve done your research before making a decision.

update: How to Avoid Capital Gains Tax When Selling Your Property

If you’re married and filing jointly, you’re exempt from taxes on the first $500,000. If you sell after more than one year of ownership, your profits will be taxed as long-term capital gains, which have lower tax rates — ranging from 0–20%. The increase what is bitbose in capital gains taxes applies to individuals with income of $1 million or more, and takes the marginal tax rate from 20% to 39.6%. When combined with a pre-existing 3.8% surtax on investment income, that makes for an effective tax rate of 43.4%.

However, you may be subject to capital gains tax if you sell your precious metals. Fortunately, there are ways to avoid or minimize your capital gains tax liability on precious metals. For instance, if you have one investment that is down by $3,000 and another that is up by $5,000, selling both will help you reduce your gains. You would only be subject to capital gains taxes on the difference – or $2,000 – rather than the full $5,000 gain of the second investment. No, generally capital gains tax does not apply to inherited properties. However, it may apply once this property is sold if it’s not your main residence.

Once again, don’t sell off stocks or other assets at a loss solely for tax reasons. When you buy low and sell high for a profit, that profit is called capital gains. What you’re buying and selling doesn’t particularly matter; it could be stocks, real estate, vintage cars, whatever. If you buy it for $100 and sell it for $150, you owe taxes on the $50 profit. Homeownership often comes with the headache of ultimately selling your home. By knowing more about the intricacies of the capital gains tax, you could line up your sale to maximize the profits you make on your home or investment property.

When you’re ready to use the money, your funds can also be withdrawn tax-free, helping you avoid capital gains yet again. At tax time, if you had losses on the sale of any capital assets, you can use those losses to offset other capital gains. Basically, you add up all your capital gains and subtract any losses. One version of this process is called year-end “tax-loss harvesting,” because you are gathering losses on some investments to lower your overall capital gains tax.

As mentioned, you and the buyer will have competing interests with regard to the allocation of the purchase price. Per the IRS rules, you’re better off allocating more of the price to capital assets rather than depreciating assets. So rather than rushing the negotiation process, it may be better to take your time in order to get the most favorable allocation. For example, you could sell a rental property and use the proceeds to buy another rental property. Or, you could sell a piece of land and use the money to buy another piece of land. To qualify for a like-kind exchange, you must sell your property and use the proceeds to buy another property within a certain period of time.